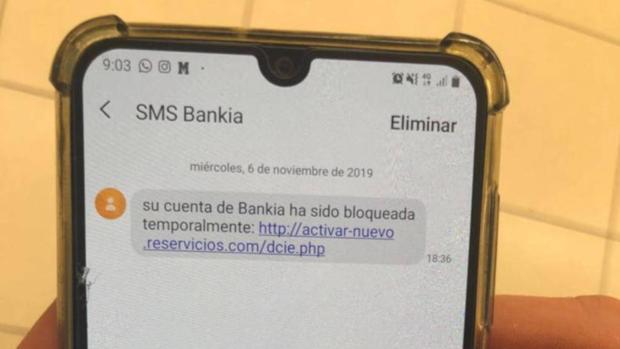

Be careful with this SMS!It is a new scam that aims to steal your bank data, according to the Bank of Spain

Surely you already know several of the stratagems used by cybercounts to steal your personal data and your money.

The most common are those of resorting to emails or SMS messages, taking over bank entities or official organisms.

These messages are written in alarm to deceive the receiver: they usually say that you have an urgent payment to avoid a fine or that the bank owes you money and you have to fill out a form to recover it.

In all these cases a link to a web page that mimics that of these companies is included.Once you provide your personal data on this way, cybercriminals can keep your data.

Cybercriminals have begun to traffic with your Internet connection: thus earn money offering access to your network

And as this type of technique is already known by many users, scammers have polished their strategies to reach the same purpose.

According to the Bank of Spain, in recent weeks there are many cases of new deception that has been called spoofing.

The trap is much more difficult to detect on this occasion: the fraudulent SMS appears in the same section that other real messages of a banking entity had previously reached.

In this way, the user has it more complicated when recognizing that the message is a scam, especially if he usually reads this type of notifications quickly and without stopping in details.

The danger of this SMS is that it appears just below communications that are very everyday, such as the keys that your bank sends for the authorizations of payments you do online.

The Bank of Spain explains that this scam is carried out by replacing the mobile phone number from which the message is sent by an alphanumeric text that appears to be the entity.

Thus, the recipient upon receiving the message does not suspect the issuer and launches the operation they have requested, biting in the hook and endangering his personal and banking data.

To identify this new trap, the Bank of Spain offers the following tips:

If you have been a victim of one of these frauds, it is best to contact your banking entity as soon as possible to give them the notice.

The bank knows how to act in these situations and can prevent major evils from happening.