Credit Bureau: How to obtain your credit history?

Being within the Credit Bureau is not about entering a blacklist of people who do not pay their debts, in fact, all the people who have ever accessed a loan are in a database that records their history in the behavior of debt payments with companies or financial institutions.

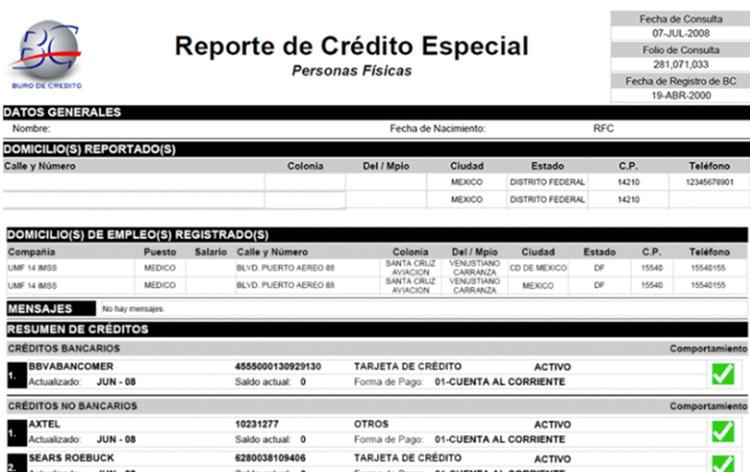

To consult your conduct in paying the loans that you have acquired in your life with financial institutions, such as banks, fintech, sofomes, etc., or commercial entities such as department stores, pay television, telephone, even loans with universities, there are credit information societies that collect this information, whether positive or negative, such as the Credit Bureau and Círculo de Crédito.

The credit report is delivered free of charge once every 12 months, after which it has a cost of around 35 pesos if requested through the web pages of the credit companies, if the credit score is added to the query credit, the cost increases.

People who wish to know their history from the Credit Bureau or Credit Circle website must enter personal information such as: Name, date of birth, Curp, RFC, address, telephone and email.

Once the personal information is registered, they will answer a questionnaire about any credit product they have, they will attach a payment method even if it is the first report requested (the charge will be canceled) and after that the file can be downloaded from the company page or from the added email.

If you have a credit card, to expedite the process, it is important to correctly enter the credit line of this, if you do it incorrectly the file will not be able to be shown. You will also wonder if you have any current mortgage or car financing.

How to Print Multiple Pages Per Sheet in Adobe Reader | https://t.co/piMAWeQ4Sl

— Mobile Tech Wed Nov 04 11:39:55 +0000 2020

Within the information provided in the report you will find a summary of credits with financial institutions, on the right side there is a date that represents the behavior of both active and closed accounts; the green color indicates that the payments are up to date, the yellow color is from 1 to 89 days late, and the red color is more than 90 days late or unrecovered debt.

Wolfgang Erhardt, spokesperson for Buró de Crédito, explained that the observation keys reflect the delay in payments, regardless of the amount owed, which can range from one peso to larger amounts, depending on each institution to report your database to these credit information companies.

After the general information, there is the detail of the debts in financial and commercial institutions, with the history of payments and an observation key, which goes from 1 to 9, where one means current account, 2 accounts late from one to 29 days; the 3 delays from 30 to 59 days; 4 non-payment from 60 to 89 days. From 5 to 8 are the keys that are given to loans that are in arrears from 90 days to 12 months and 9 concentrates arrears of more than 12 months, accounts with partial or total unrecoverable debts or consumer fraud.

In addition to data on acquired credits, the detail of inquiries to the Bureau carried out by institutions or companies that have reviewed the information to provide some financing is also shown.

Financial or non-financial entities, when consulting people's credit reports, define whether they are creditors of financing or limit the amount that they could be granted. That is to say, that even though you have some delays in payments, you could obtain financing, but with conditions adjusted to your profile.

Filed in:

Bank credit bureau