How can the $600 COVID relief be obtained in California and how quickly will it arrive?

California Governor Gavin Newsom signed into law a sweeping economic relief package for COVID-19 on Tuesday.

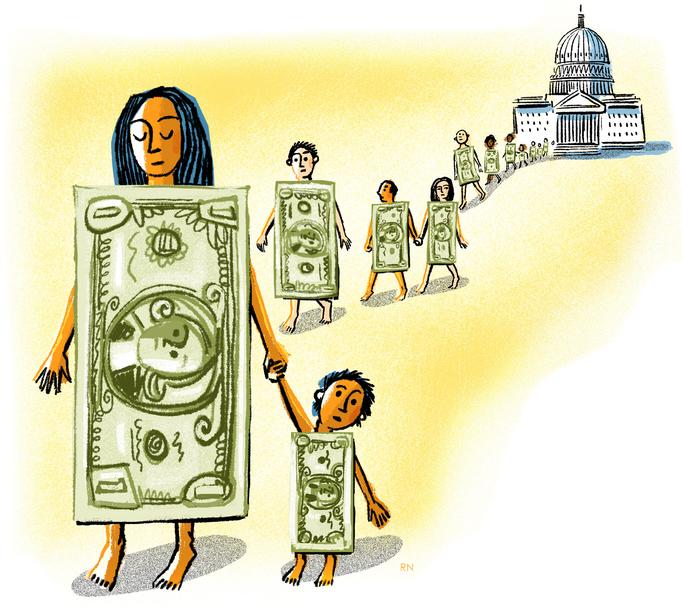

It will provide financial help to millions of people who have been affected by the pandemic.

“This $7.6 billion of direct assistance that we are providing today not only helps small businesses, but supports an estimated 5.7 million Californians with direct stimulus check relief,” Newsom said during a signing ceremony at Solomon's. Deli in Sacramento.

Here's what to expect in the coming weeks, along with information on how to reap the benefits:

AdWho will receive the help?

About $3.8 million of the payments will go to households that qualified for the 2020 state income tax credit, which is available to residents making less than $30,000 annually.

About 565,000 stimulus payments will go to those with individual tax identification numbers who did not receive federal stimulus payments and whose income is less than $75,000, many of whom are undocumented immigrants.

"For those who did not receive the federal stimulus, California is not going to leave them behind," Newsom said Tuesday.

Individual identification number taxpayers who also qualify for the California state income tax credit will receive a total of $1,200 in state stimulus.

The $600 stimulus payments will also go to 1.2 million people who receive money from the federal Supplemental Security Income (SSI) or State Supplemental Payment (SSP) programs, and 405,000 payments will be provided to CalWORKS participants, the state program for transition to working life. An additional 15,000 payments are planned for participants in the Immigrant Cash Assistance Program.

CalWORKS payments will be placed on debit cards and delivered to participants in mid-April, though the schedule could change based on the ability to automate the process, said HD Palmer, a spokesperson for the California Department of Finance. The schedule and method of payment of benefits for SSI and SSP recipients are still being worked out and depend on discussions with the federal Social Security Administration, he added.

How quickly will help arrive?

Beneficiaries could receive the money within a month after filing their tax returns.

Stimulus aid for residents earning $30,000 a year or less will arrive four to five weeks on average after they file 2020 tax returns with the State Board of Taxation. The wait could be a month for those with the direct deposit option and up to seven weeks for those who receive a state check in the mail.

Where does the money come from?

How to Connect a D Link Dpr 1260 RangeBooster G Multifunction Wireless #Print Server to a Laptop http://t.co/WF4ZtyGR

— gjhgj Wed Nov 21 20:30:10 +0000 2012

The COVID-19 relief package has been made possible by higher-than-expected California tax revenues, despite the economic hardship caused by the pandemic.

Business

What about aid to companies?

The aid package approved by the Governor and Legislature also provides $2.1 billion in grants ranging from $5,000 to $25,000 under a program administered by the California Office of the Small Business Advocate.

The Legislature's approval of the grant money came a few months after Newsom launched the program with an executive order that provided $500 million in grants to 21,000 small businesses.

But the demand for grants is greater than the money available. In the first round of grants, 350,000 small businesses applied, requesting more than $4.5 billion, according to officials.

Businesses with annual gross receipts of up to $2.5 million are eligible. Since there is not enough money for all applicants to receive a grant, applications are ranked and judged based on criteria such as whether the company is in a sector severely affected by the pandemic.

Applications will also be screened to ensure there is a wide geographic distribution and that businesses owned by people of color are fairly represented.

Once a business is notified that it has been selected for a grant, it will have to meet additional verification requirements before the money is disbursed, said Kaitlin Lewis, a state spokeswoman.

What are other items to consider?

A proposal that would allow businesses to deduct up to $150,000 in expenses covered by Federal Paycheck Protection Program loans is scheduled to be voted on this week. More than 750,000 PPP loans were taken out by California small businesses, according to officials.

The bills passed Monday also provide for a two-year reduction in rates for some 59,000 restaurants and bars licensed by the state Department of Alcoholic Beverage Control. They typically pay annual fees ranging from $455 to $1,235. In addition, the fees for more than 550,000 hairdressing and cosmetology business licenses will be eliminated.

Likewise, 50 million dollars will be allocated to grants for cultural institutions that have suffered economically due to the pandemic. The package also includes scholarships for community college students, and additional money for childcare, food banks, diapers and housing for quarantined farmworkers.

To read this note in English click here