Easy Rent Guide 2020 (XII): The keys to transferable income

- Xavier Gil Pecharromán

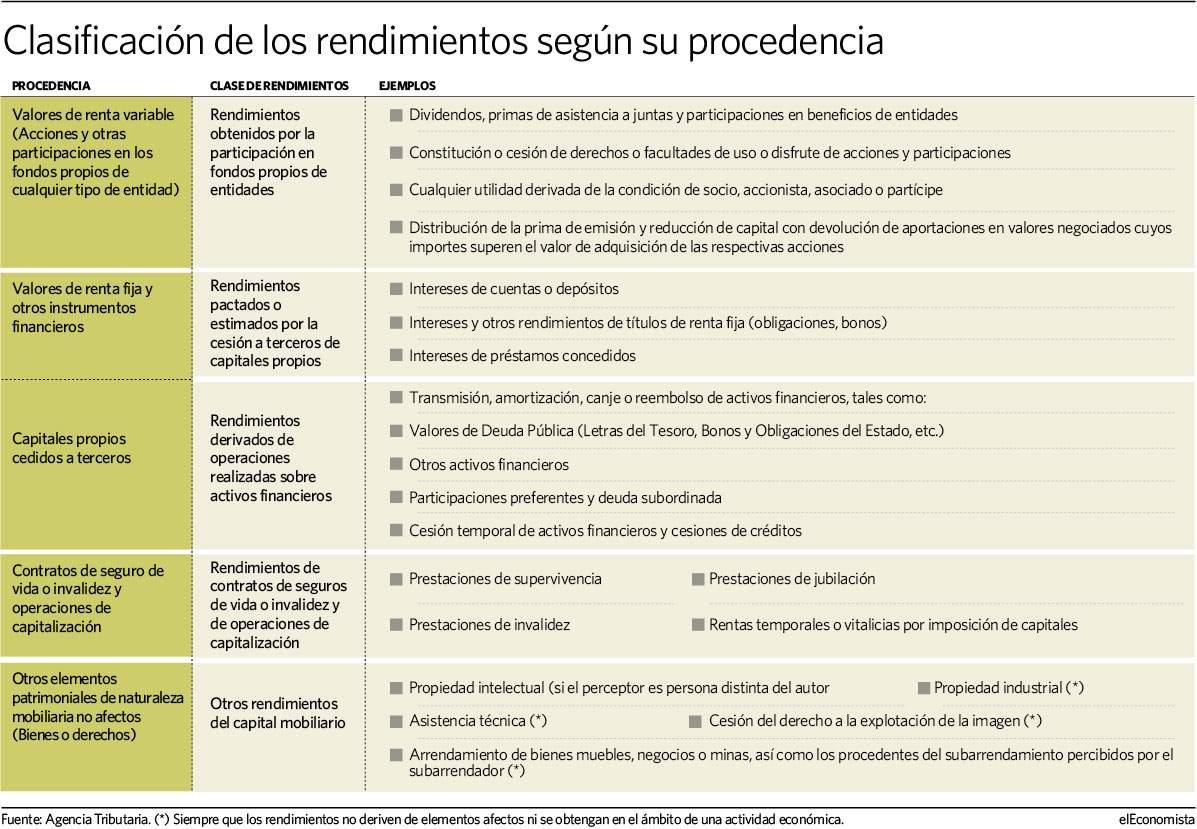

They are considered full yields of furniture capital the totality of the profits or consideration, whatever their denomination or nature, monetary or in kind, that come directly or indirectly from patrimonial elements, goods or rights whose ownership corresponds to the taxpayer, which does notThey are affected by its economic activities and, in addition, they are not classified as real estate.

It is necessary to take into account that since January 1, 2019, the type of retention and income on account applicable to the yields of furniture from intellectual property when the taxpayer is not the author, has been reduced from 19% to 15%.

The income is divided into two types, according to their integration into the base of savings or in the general base.Savings income for savings are formed, furniture capital obtained for participation in own funds of any type of entity;those captured by transfer to third parties of own capital;those from capitalization operations;of life or disability insurance contracts, except when they must pay as work returns;and income derived from capitals imposition.

Assignment to third parties of capitals

It is considered, for fiscal purposes, assignment to third parties of own capital the consideration of all kinds, monetary or in kind, such as interest and any other form of compensation agreed as remuneration for such assignment, as well as those derived from transmission, reimbursement, reimAmortization, exchange or conversion of any kind of assets representative of the collection and use of foreign capital.

They have this consideration: 1) The yields of any turn instrument, even those originated by commercial operations, from the moment in which it is endorsed or transmitted, unless the endorsement or assignment is made as payment of a loan of suppliers or suppliers;2) The consideration, whatever its denomination or nature, derived from accounts in all kinds of financial institutions, including those based on financial assets operations;3) income derived from temporary transfer operations of financial assets with repurchase pact;and 4) the income satisfied by a financial entity, for the transmission, assignment or transfer, total or partial, of a credit owned by that.

The Accounts Contract in Participation by which one person gives to another the use of a capital with the purpose, in this case, to intervene in real estate businesses, participating both -gestor and participant- in the prosperous or adverse results of the operation in operation inThe agreed proportion is for the purposes of IRPF a transfer to third parties (manager) of own funds (participant), so the yields are qualified as the furniture capital.

The preferred preferential participations complying with the requirements included in Law 13/1988 benefit from a special financial and fiscal regime, which qualifies them as returns by the transfer to third parties of own capital.

Interestless loans

They are presumed paid, except proves to the contrary, the benefits of goods, rights or services that can generate capital returns.If a natural person who does not participate in any way in a society, lends money from his personal assets to a society without applying interest or remuneration, the assessment of the estimated income is carried out by the normal value in the market.Thus, the market value is understood, the consideration that would be agreed between independent subjects, except proof to the contrary.If it is loans and operations for capturing or use of foreign capital in general, normal value in the market is understood as the legal interest rate of money in force on the last day of the tax period.

Issue cousin

The amount obtained by the distribution of the company's issuance premium to the MINORA partners, until their cancel.

Are you new to word for mac or need to refresh on cutting, copying, and pasting?If so, this week’s tutorial is fo ... https: // t.CO/6XTE0QT96G

— Erin Wright Mon Jul 26 16:17:58 +0000 2021

If the distribution of the issuance premium determines yield and subsequentlyThese minor the acquisition value of the same, with the limit of furniture yields previously computed by the distribution of the issuance premium.

While there is no obligation to practice retention or income on account of yields from the return of the premium of issuance of shares or shares and the reduction of capital with return of contributions, it will not be so if they come from not distributed benefits.For entities that distribute issuance or reduce capital with contributions, in relation to the distributions made not subject to retention, a new information obligation is expected.

Revaluation guarantees

If the banking entity marketed of an investment fund, which gives a guarantee of revaluation of the shares to a certain date, delivers the difference between the guaranteed value and the liquidative value, it is before an independent accessory business of the main participation subscription.The guarantee seeks to provide minimal investment yield and results in furniture yield.

The totality of the amount liquidated as a guarantee of revaluation will be considered the performance of the furniture capital, subject to retention, and must be integrated in such a concept in the Declaration of the IRPF of the exercise in which said amount has been enforceable.

Life insurances

In the benefit obtained by a taxpayer as a beneficiary of life insurance for the death of his spouse in the economic regime of property, if the insurance was celebrated by stating that the payment of the premiums was in charge of the current property company between theContractor and the beneficiary, it is only subject to the Tax on Inheritance and Donations (ISD) half of the amount received by the beneficiary, paying the other half in the IRPF.

Since there is the possibility of paying premiums with private goods, it is presumed that if only a spouse in the contracting party intervenes, without express reference in the contract that the payment is gatial, the contract was held only in charge, paying tributingThe total amount received by the SUBÉRTETITE in E LSD and not by the IRPF, unless it is a mortgage creditor.

Insurance and 'Pias'

Individual systematic savings plans (PIAS) are configured as contracts concluded with insurance entities to constitute with the resources provided an insured life income.Income revealed at the time of the constitution of insured life income are exempt.Immediate life insurance contracts generate for their receiver, when he coincides with the insurance contractor, furniture yields.

Immediate temporary income insurance contracts generate for those who charge them, when the insurance contractor, furniture yields is in turn.

They are taxed as returns from furniture by difference between the perceived capital and the amount of the satisfied premiums that have generated the capital that is perceived, integrating into the tax base of the savings of the personal income tax, without the application of any reduction percentage.

The profitability derived from the provisions or bailouts that the taxpayer performs to adapt to compliance with the annual, total limits, or both of the PIAS, taxes as the performance of the furniture from the life of life insurance contracts.

The transformation of a life insurance contract into an individual systematic savings plan (Pias) is only possible to carry it out at the same time for the constitution of life income.

The transformation can be carried out by the taxpayer through agreement with the insurance entity documented in the same letter that constitutes the life income, and must be recorded expressly and highlighted in the conditioning of the contract that is transformed that it is a pias.Integrated into the General Base

They are included in the general base, among others, those from intellectual property when the taxpayer is not the author;those of industrial property does not affect economic activities;Those of the provision of technical assistance.

Also, those from the lease of movable property, businesses or mines;of sub -rendering perceived by the sub -leader;of the transfer of image rights, unless such assignment takes place within the scope of an economic activity;And, in addition, the consideration obtained by the postponement or fractionation of the price of sale operations, unless the operations are carried out in the taxpayer's economic activity.

Business lease

There is business lease when the lessee receives, in addition to the premises, the business or industry, so that the object of the contract is not only the goods that are found in it, but a heritage unit with its own life and susceptible to being immediately exploited orpending to be administrative formalities.

This implies the previous existence of a company or business that was exploited by the lessor prior to the lease and is considerate of furniture yields.

Linked income

They are part of the general income the yield yields derived from the excess of the amount of the capitals assigned to an entity linked to the result of multiplying by three their own funds, in the part that corresponds to the participation of the taxpayer, of the latter.

Income in kind

In this case, it is necessary to take into account that the income satisfied in kind is valued for their normal market value.This value must be added the entry on account, unless its amount has been impact on the receiver of the rent.

The entry on account must be determined by the person or paying entity by applying the percentage that corresponds to the result of increasing the acquisition or cost value for the payer of the good, right or service delivered by 20%.