The keys to the judgment of the TJUE that tomba the sanctions for not declaring goods abroad

The Court of Justice of the European Union, Tjue, has amended the flat to Spain for "disproportionate" people who had assets abroad and had not declared them, they had done it wrong, or reported it.of term.

The Government has reacted with the announcement that the laws will be adjusted to comply with the sentence, which according to the Minister of Finance could mean the return of about 230 million euros, although it has added before making an assessment, it will be necessary to see "the small letter".

Nius has spoken with two fiscal lawyers, who give us the keys to what this resolution supposes and what the 720 model has meant, in question by European justice.

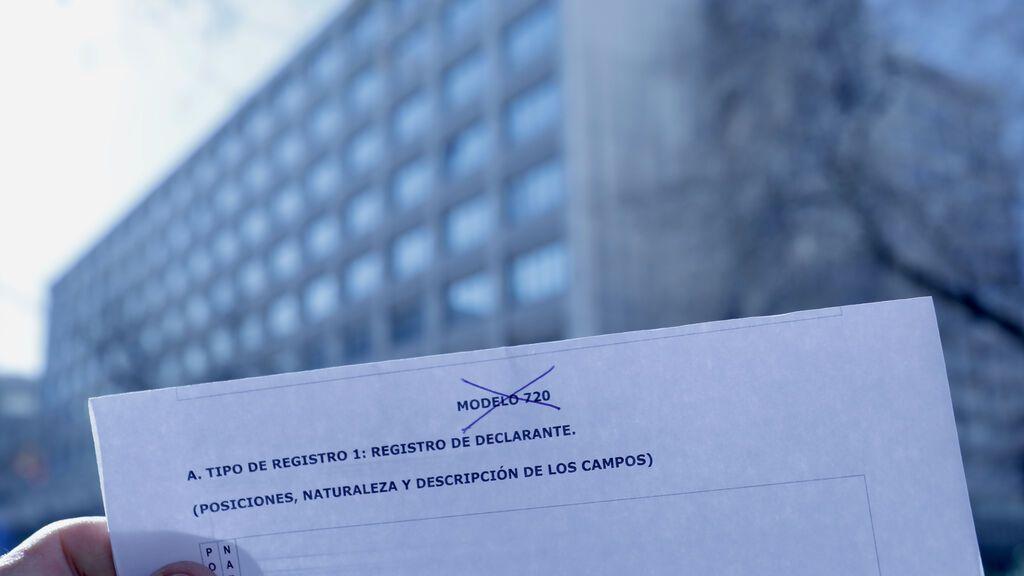

What is the 720 model?

This is an informative statement that must submit to the Treasury those who have goods abroad.It was created in 2012, after the fiscal amnesty of the former Minister of Finance Cristóbal Montoro, which allowed you to have goods without declaring in other countries could do so in advantageous and exempted tax conditions of the possible crime of having evaded taxes.

Tomás Lamarca, an expert prosecutor in International Taxation of Lean Lawyers, explains that it was a kind of "stick", after "the carrot" that the fiscal amnesty meant.Who did not declare, and was surprised by the Treasury, had to pay a fine of 150% of everything he had outside of Spain.

Will the obligation to inform the goods disappear?

No, it will not disappear, and this was recalled by the Minister of Finance, Mª Jesús Montero, who has reminded taxpayers who have to submit their statements before March 31.

Almudena Medina, a specialist lawyer in International Taxation of CECA Magán Lawyers is clear that the obligation to pay will remain there and that there will be some kind of sanction.The problem in this case is that it is a "burden" regime, which has no comparison or what is paid for the goods here or with the fines established by other countries of our environment.

What does the sentence say?

Basically three things:

- Que las multas son desproporcionadas y además no hay límite máximo de dinero a pagar.

- Que no puede ser que no haya prescripción de la irregularidad.

- Que invade la libre circulación de capitales.

But what are those fines?

Who has to present this model?

All residents in Spain who have goods abroad valued by more than 50.000 euros.The amount is calculated separately depending on the type of good, and there are three:

That presentation is made the first time, then you have to inform only the increases.

Almudena Medina and Tomás Lamarca explain that each property is a fact, each account too, and that each action counts as data.The two give the same example, the actions are always many, and the fine of 5.000 or 10.000 euros for each can rise in a stratospheric way.

What will the government do?

The norm will be corrected "with the greatest speed", as assured by the Minister of Finance, Mª Jesús Montero, who has estimated in about 230 million the possible returns.

Tomás Lamarca points out that how far he knows, the advice of the majority of prosecutors to his advisory has been to present the model and assume the fines, so he would not be surprised if it was more money than the minister calculates.

For his part, Almudena Medina points out that many people have not paid for response to their resources and also to the decision of the TJUE, which responds to a resource of 2013.

Who is affected?

As they are private and protected information, the Treasury does not give the names of those affected by this decision, however, some such as the Pujol have sent their conviction that they will have to return the "1.7 million euros" that they contributed to theregularize your accounts in Andorra in 2014.

As for King Emeritus, Fuentes de Finance consider that he does not affect him, because he has not recognized goods abroad, but having enjoyed a heritage for which he did not pay.But he has not submitted accounts, real estate or actions in his name.

Who had already won the battle to the Treasury for the 720 model was a retired taxi driver from Granada, who had worked in Switzerland and had 340 invested.000 euros in a SICAV (variable investment) in Luxembourg.He filed the statement, but he did it a year late and the Tax Agency made his claim that was more than invested.

The retiree did not reach the ordinary courts, because he got the Administrative Economic Court, which depends on the Treasury to give him the "absence of bad faith".However, your case realizes what the sanctions of this model suppose.